Re-thinking the EYA approach and building confidence for investors

For wind and other renewable projects to be successful, they need to be grounded in commercial reality. During a project’s pre-construction phase, predicting the future energy yield is not always clear cut.

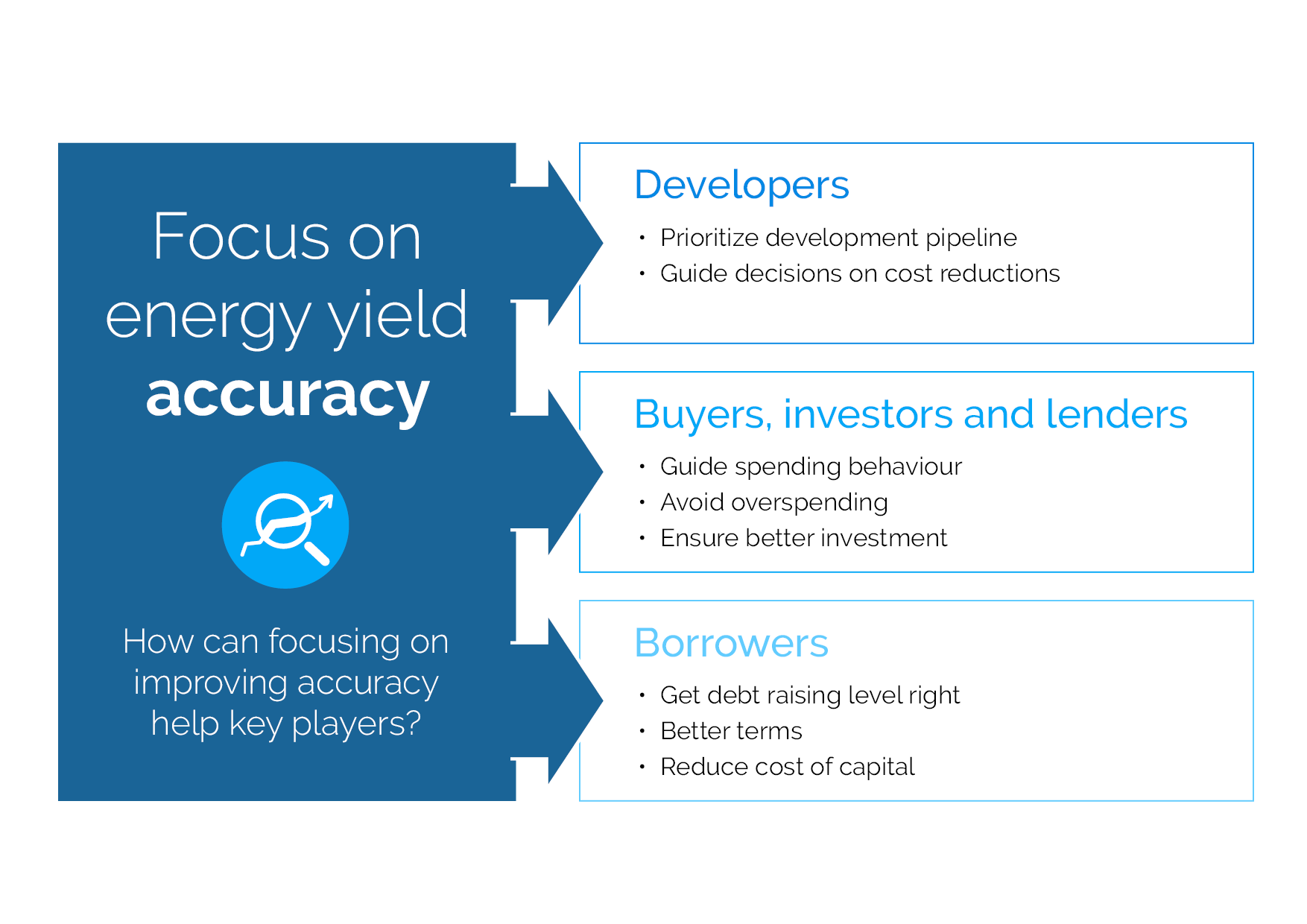

Consistently achieving greater accuracy is something that key players working across the project investment and development process are focussed on:

- For developers: achieving greater yield prediction accuracy can help prioritize the development pipeline and help guide decisions on cost reductions;

- For buyers, investors and lenders: it can help guide spending behavior, avoid overspending and ensure a better investment; and

- For borrowers: it can help ensure that the right level of debt is raised, with better terms and might even reduce (or at least provide a greater understanding of) the cost of capital.

What does the current energy yield analysis approach look like?

The current approach relies on applying long-term average adjustments to arrive at a long-term energy yield prediction. This provides a quick and easily understood analysis, which has served the industry well to date.

However, this approach requires a number of approximations; time independence being amongst the most significant. As we move to a subsidy free era and profit margins are squeezed for the wind industry, the requirement for accuracy will increase, making this approximation less palatable.

The physical reality is that the energy yield of a wind farm – and thus the revenue stream – varies over time. Natural variations in wind speed, turbine curtailment and the energy price are just a few of the factors at play here.

Wind turbines are typically subject to specific curtailment issues. For instance, consent conditions may dictate that all turbines located at a given wind farm are shut-down for a two-hour period at dusk to protect bats. A standard approach may be to assume that the wind farm’s energy yield will suffer a one-twelfth loss due to a two-hour shutdown each day. However, because this approach does not consider the other factors at play here – e.g. wind speed during the time of curtailment – the end analysis provides a relatively crude and inaccurate prediction of the impact on energy yield.

How can we predict energy yield with greater accuracy?

Adapting an analysis approach that looks at time dependent factors – such as power output variations throughout the day – will enable the interdependence of different factors to be considered and allow the pin-pointing of various curtailments when they occur. By taking this approach, approximation and errors can be reduced, resulting in a more accurate prediction of what the full curtailment impact is likely to be.

Why aren’t we already using this approach?

A number of technical and commercial challenges stand in the way of shifting to an entirely time‑dependent approach.

From a technical perspective, whilst industry does have the capability to overcome this, one of the key challenges is the need for comprehensive automation of analysis, and increased IT resources to cope with much larger quantities of data. Commercially, the challenge is to overturn the current and well‑established industry approach, which may take time to gain acceptance.

Achieving change overnight is unrealistic and industry should instead take a ‘marginal gains’ approach – seeking comprehensive validation to prove the value of time‑dependent analysis, incrementally building confidence in the merits of this approach.

The 'marginal gains' approach

When it comes to energy yield predictions, evolving to time-dependent analysis more closely represents physical reality and this provides real added value. In turn, this approach will build confidence and provide comfort that investment decisions are as well-informed as possible.

Whilst technical and commercial challenges remain, these are by no means insurmountable. We should not expect the well-established industry standard approach to be thrown out overnight, but by adopting innovation-led ‘marginal gains’ the wind industry can shift to a modern, more certain and confidence inspiring approach.